For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

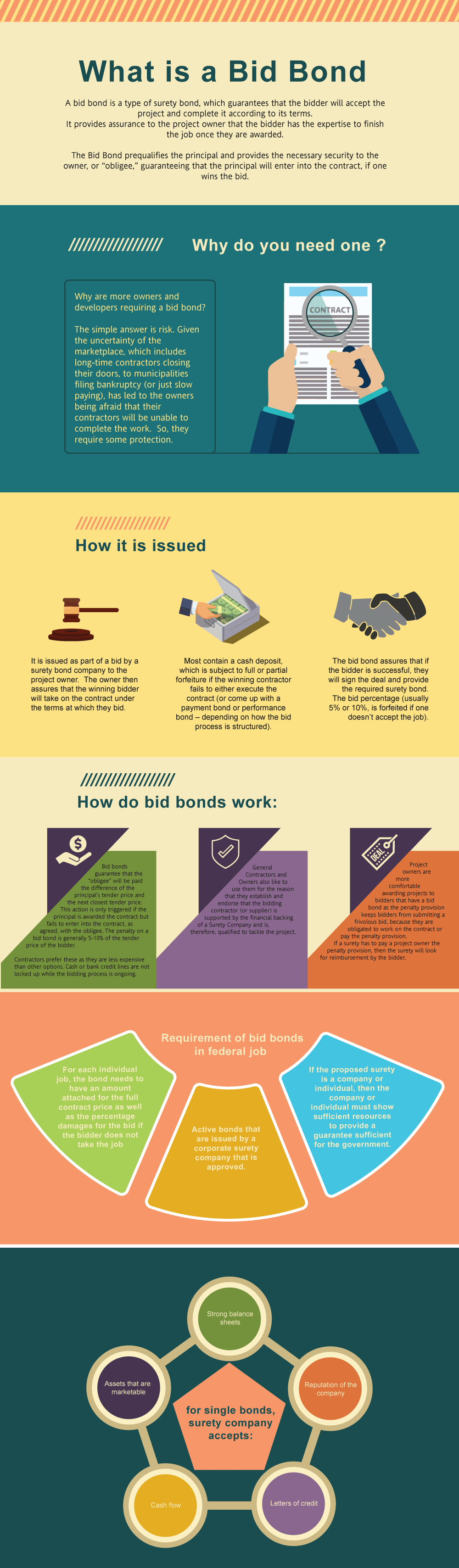

What is a Bid Bond in Iowa?

A bid bond is a type of surety bond, that guarantees that the bidder will take the job and complete it according to its terms. It provides assurance to the project owner that the bidder has the knowhow and ability to finish the job once the bidder is selected after winning the bidding process. The simple reason is that you need one to get the work. But the larger question is why are more owners/developers requiring a surety bid bond? The answer is risk. Given the uncertainty of the marketplace, which includes long-term contractors closing shop, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to finish the work. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Iowa Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Iowa?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the contract bond if you win the bid. The cost can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond covering the subsequent contract.

How much do bonds cost in IA?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Iowa. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors. See our Performance Bond Cost page for more.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Iowa?

We make it easy to get a contract bid bond. Just click here to get our Iowa Bid Bond Application. Fill it out and then email it and the Iowa bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We thoroughly review each application for surety bonds and then submit it to the surety that we believe will provide the best surety bond for your contract. We have a great success rate in getting our clients bid and P&P bonds at the very best rates possible.

Unveiling Iowa Bid Bond

From our perspective, an Iowa bid bond is a crucial instrument in the construction and public project industries. It ensures that contractors who submit bids are serious about completing the work if awarded the contract. Essentially, this bond guarantees that the project owner is financially protected if the winning contractor decides to back out after the bid is accepted. We’ve consistently found that bid bonds in Iowa provide a layer of security and trust in competitive bidding processes, particularly in public works projects.

Find a Bid Bond Near Me

We’ve come across several effective ways to locate bid bond providers in Iowa. First, online searches for “Iowa surety bond companies” yield quick results, connecting you with local providers. We’ve learned that another method is to contact your local insurance agents, as many specialize in contractor services and often provide bid bonds. Finally, networking with fellow contractors or colleagues can offer personal recommendations. We’ve noticed that seeking advice from industry peers often helps in finding reliable, trustworthy surety companies in the area.

Who Should Get the Bond in Iowa?

We’ve observed that bid bonds in Iowa are typically secured by the following entities:

- General Contractors: We’ve often noticed that general contractors bidding on large public or private projects are required to obtain bid bonds. These bonds ensure that the contractor is financially capable of executing the project if awarded.

- Subcontractors: In our experience, subcontractors working under general contractors also need bid bonds, particularly on larger jobs. This helps guarantee the completion of their specific portion of the project.

- Suppliers: We’ve encountered situations where suppliers involved in large-scale projects must secure bid bonds to ensure that the materials they commit to providing are delivered as agreed.

- Government Contractors: Contractors working on government-funded projects, such as public infrastructure improvements, are almost always required to carry bid bonds before their bids are accepted. From what we’ve seen, this requirement helps protect public funds and ensures the contractor is serious about the job.

- Private Project Contractors: Although more common in public projects, we’ve noticed that some large private entities also require contractors to carry bid bonds, especially when the project is of significant size and scope.

These various entities benefit from the protection and assurance that bid bonds provide, helping to foster trust and accountability in Iowa’s competitive construction bidding environment.

We provide bid bonds in each of the following counties:

Adair

Adams

Allamakee

Appanoose

Audubon

Benton

Black Hawk

Boone

Bremer

Buchanan

Buena Vista

Butler

Calhoun

Carroll

Cass

Cedar

Cerro Gordo

Cherokee

Chickasaw

Clarke

Clay

Clayton

Clinton

Crawford

Dallas

Davis

Decatur

Delaware

Des Moines

Dickinson

Dubuque

Emmet

Fayette

Floyd

Franklin

Fremont

Greene

Grundy

Guthrie

Hamilton

Hancock

Hardin

Harrison

Henry

Howard

Humboldt

Ida

Iowa

Jackson

Jasper

Jefferson

Johnson

Jones

Keokuk

Kossuth

Lee

Linn

Louisa

Lucas

Lyon

Madison

Mahaska

Marion

Marshall

Mills

Mitchell

Monona

Monroe

Montgomery

Muscatine

O’Brien

Osceola

Page

Palo Alto

Plymouth

Pocahontas

Polk

Pottawattamie

Poweshiek

Ringgold

Sac

Scott

Shelby

Sioux

Story

Tama

Taylor

Union

Van Buren

Wapello

Warren

Washington

Wayne

Webster

Winnebago

Winneshiek

Woodbury

Worth

Wright

And Cities:

Des Moines

Cedar Rapids

Davenport

Iowa City

Ames

Waterloo

Dubuque

Sioux City

Council Bluffs

Ankeny

Cedar Falls

See our Kansas Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Helpful Advices When Thinking of Bid Bonds

We’ve discovered through experience that preparing for a bid bond application requires attention to detail and planning. Here are some practical tips:

- Work with a reputable surety company: From our experience, choosing a surety with a solid reputation ensures smoother transactions.

- Keep financial records updated: We’ve realized that clear and current financial statements help expedite the bond approval process.

- Understand the bond requirements: We’ve often noticed that knowing the specific bid bond requirements can prevent delays.

- Apply early: We’ve consistently found that starting the bond process well before the bidding deadline helps avoid last-minute issues.

Learning What A Surety Bid Bond Is

We’ve gained insight into surety bid bonds, which are a three-party agreement between the contractor (principal), the project owner (obligee), and the surety company. Here’s a breakdown of how surety bid bonds work:

- Protects the project owner: We’ve often noticed that bid bonds provide assurance that the contractor is committed to the project.

- Covers financial damages: If the contractor fails to honor the bid, the surety covers the cost difference if a new contractor must be hired.

- Ensures competitive bidding: From our perspective, surety bid bonds ensure the integrity of the bidding process by discouraging non-serious bidders.

Exploring How Surety Bid Bonds Work

We’ve personally witnessed the straightforward process of bid bonds, which involves the following steps:

- Application: Contractors submit financial documents and project details to the surety company for review.

- Underwriting: The surety evaluates the contractor’s credit, financial stability, and project experience.

- Bond issuance: Once approved, the surety issues the bid bond, which assures the project owner that the contractor will sign the contract if they win the bid.

The Application for a Surety Bid Bond in Iowa

We’ve worked closely with contractors applying for surety bid bonds and identified these key steps:

- Submit financial documents: In our observation, clear financial records significantly help with approval.

- Provide project information: We’ve seen firsthand that detailing the project scope and value helps the surety assess the bond's risk.

- Fill out application forms: We’ve noticed that accurate and complete information is critical for avoiding delays in the process.

The Price of a Surety Bid Bond in Iowa

We’ve gathered from our experience that the cost of a surety bid bond in Iowa generally ranges between 1% and 3% of the project bid. Here’s a deeper look at what influences the price:

- Contractor’s financial standing: We’ve been fortunate to secure lower premiums for clients with strong credit scores.

- Project size: Larger projects typically require higher bond amounts, which may lead to higher premiums.

- Surety’s risk assessment: We’ve often noticed that sureties evaluate the risk involved with the project and adjust prices accordingly.

Navigating Complexities: Is There a Chance of Being Denied?

We’ve been through situations where contractors have been denied bid bonds for several reasons, including:

- Poor credit history: From our experience, contractors with low credit scores may find it challenging to secure a bid bond.

- Insufficient financial records: We’ve seen firsthand that incomplete or weak financial statements can lead to denials.

- Lack of project experience: In our professional life, we’ve encountered situations where sureties deny bonds to contractors who lack relevant project experience.

Final Insights on Bid Bonds in Iowa

From our own dealings with bid bonds in Iowa, we’ve come to recognize their critical role in construction projects. They safeguard project owners while giving contractors the credibility they need to secure large contracts. We’ve observed over time that preparation is key—contractors with strong financials, relevant experience, and a good relationship with sureties are more likely to win bids and succeed in this competitive environment. Understanding the nuances of bid bonds and working proactively can make all the difference in the outcome of a project bid.