You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

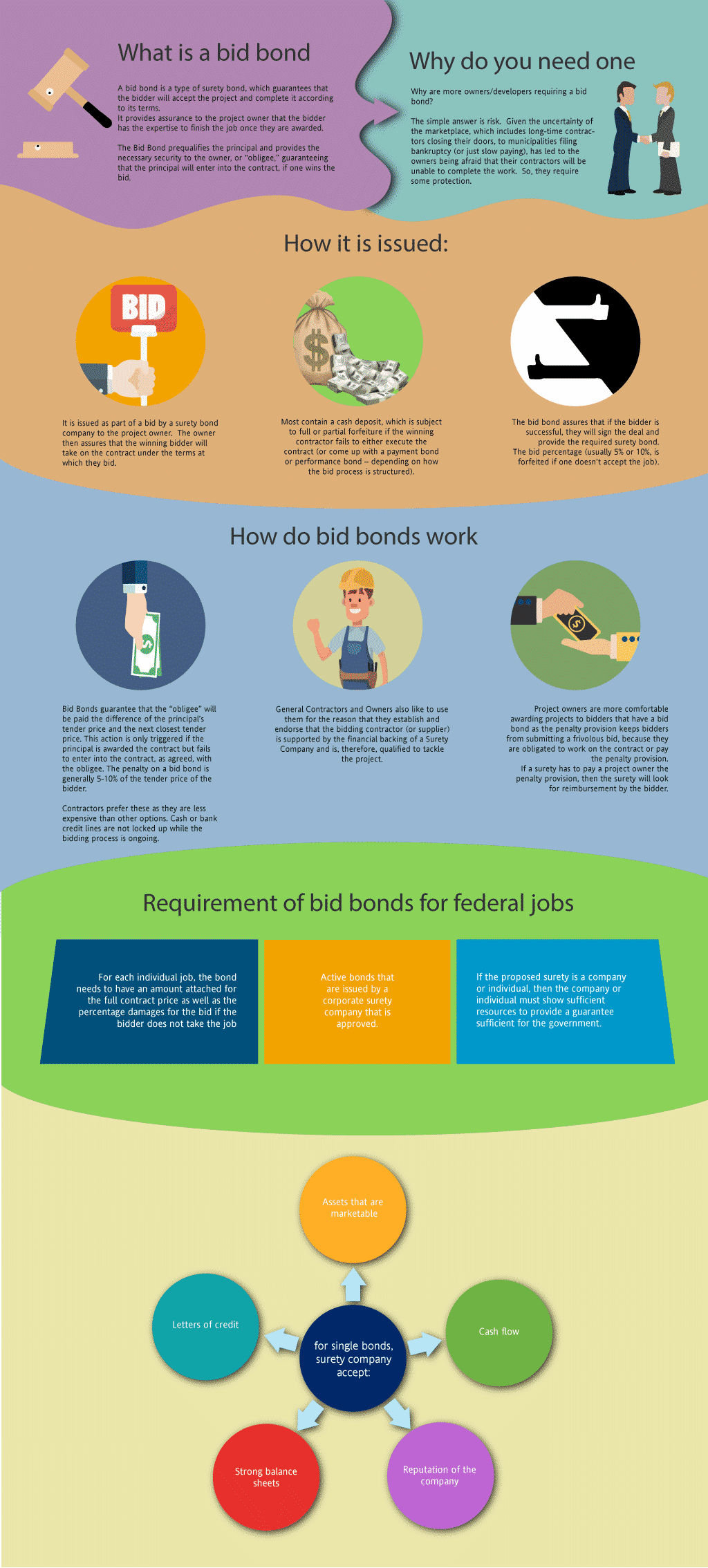

What is a Bid Bond in Indiana?

A bid bond is one of the types of surety bonds, that guarantees that the bidder will accept the contract and complete the contract according to its terms. The bid bond provides assurance to the project owner that the bidder has the expertise and capability to complete the job once you are selected after the bidding process. The simple reason is that you need one to get the contract. However, the bigger question is why are more owners/developers requiring a bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes long-term contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the job. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Indiana Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Indiana?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the contract bond if you win the contract. The cost of a this can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the subsequent contract.

How much do bonds cost in IN?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Indiana. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors. See our Performance Bond Cost page for more.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Indiana?

We make it easy to get a contract bid bond. Just click here to get our Indiana Bid Bond Application. Fill it out and then email it and the Indiana bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each and every application for bid bonds and then submit it to the surety that we believe will provide the best surety bond for your contract. We have a great success rate in getting our clients bid bonds at the best rates possible.

Igniting Your Passion for Understanding an Indiana Bid Bond

In our experience, understanding the foundational aspects of an Indiana Bid Bond can be the key to navigating public and private construction projects successfully. A Bid Bond is a type of surety bond required by project owners to ensure that contractors place bids in good faith. Essentially, it guarantees that the bidder, if awarded the contract, will enter into the contract and provide the required performance and payment bonds. The Bid Bond serves as a safeguard for project owners, offering financial protection in case the winning bidder fails to uphold their promises. We’ve consistently found that this bond instills confidence in both contractors and project owners, fostering smoother project management in Indiana’s competitive construction industry.

Finding Your Voice in Locating Bid Bonds Near Me

We’ve often found ourselves fielding questions from contractors and businesses about finding Bid Bonds in Indiana. The process is more straightforward than it may seem, especially with the advent of online surety providers and local agencies. Contractors can start by contacting local surety bond companies or working with brokers who specialize in Indiana-specific bonds. We’ve discovered that major cities like Indianapolis, Fort Wayne, and South Bend have a wealth of surety bond providers. The key is choosing a provider who understands the nuances of Indiana’s construction laws and regulations. From our perspective, working closely with a local provider can make the process more seamless and efficient.

Synergizing Your Potential with Bid Bonds in Indiana: Who Qualifies?

We’ve encountered a variety of individuals and entities who require Bid Bonds in Indiana. Primarily, contractors bidding on public construction projects must secure a Bid Bond as part of their proposal. Municipalities, state agencies, and even some private project owners may also require these bonds to protect their investments. Based on our experience, general contractors, subcontractors, and construction companies of various sizes frequently apply for these bonds. Moreover, small businesses and minority-owned enterprises competing for Indiana’s state projects often benefit from obtaining Bid Bonds to demonstrate credibility and financial responsibility. We’ve consistently observed that securing a Bid Bond opens doors to new opportunities in Indiana’s vibrant construction market.

We provide bid bonds in each of the following counties:

Adams

Allen

Bartholomew

Benton

Blackford

Boone

Brown

Carroll

Cass

Clark

Clay

Clinton

Crawford

Daviess

Dearborn

Decatur

De Kalb

Delaware

Dubois

Elkhart

Fayette

Floyd

Fountain

Franklin

Fulton

Gibson

Grant

Greene

Hamilton

Hancock

Harrison

Hendricks

Henry

Howard

Huntington

Jackson

Jasper

Jay

Jefferson

Jennings

Johnson

Knox

Kosciusko

La Porte

Lagrange

Lake

Lawrence

Madison

Marion

Marshall

Martin

Miami

Monroe

Montgomery

Morgan

Newton

Noble

Ohio

Orange

Owen

Parke

Perry

Pike

Porter

Posey

Pulaski

Putnam

Randolph

Ripley

Rush

St. Joseph

Scott

Shelby

Spencer

Starke

Steuben

Sullivan

Switzerland

Tippecanoe

Tipton

Union

Vanderburgh

Vermillion

Vigo

Wabash

Warren

Warrick

Washington

Wayne

Wells

White

Whitley

And Cities:

Indianapolis

Fort Wayne

Evansville

Bloomington

South Bend

Carmel

Columbus

Terre Haute

Muncie

Elkhart

Gary

See our Iowa Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Expert Tips for Sustainable Success with Practical Advice on Bid Bonds

In our view, the process of securing a Bid Bond can be made easier with a few practical tips:

- Start Early: From our own observations, starting the bond application process early ensures you have enough time to meet submission deadlines.

- Know Your Limits: We’ve realized that being aware of your financial capabilities is crucial to prevent overextending when bidding on larger projects.

- Work With a Reputable Surety: We’ve found through experience that partnering with a surety provider with a deep understanding of Indiana’s construction industry leads to smoother approvals.

- Maintain Strong Financials: Our experience tells us that keeping your company’s financial health in check boosts your chances of bond approval.

- Stay Informed: We’ve noticed that keeping up with Indiana’s bidding and bonding regulations helps avoid costly mistakes.

Unlocking the Secrets of Surety Bid Bonds

We’ve gained insight into how Surety Bid Bonds work and why they’re indispensable in Indiana’s construction landscape. A Surety Bid Bond involves three key parties: the contractor (principal), the project owner (obligee), and the surety company. In simple terms, the surety guarantees the obligee that the principal will honor their bid and, if awarded the project, execute the contract as agreed. What we’ve discovered is that Surety Bid Bonds serve as a form of financial security for project owners, ensuring that contractors are not only qualified but also serious about completing the project.

Diving Deep into Bid Bonds and How They Work

We’ve learned that the mechanism of Bid Bonds is relatively straightforward yet essential for Indiana’s construction projects. Here’s a step-by-step breakdown:

- Contractor Submits a Bid: When bidding on a project, the contractor includes a Bid Bond as part of the proposal.

- Owner Evaluates Bids: The project owner reviews all bids and selects the most competitive one.

- Bid Bond Activated: If the winning contractor fails to honor their bid or provide the necessary performance bond, the owner can claim the Bid Bond.

- Surety Involvement: The surety company compensates the project owner up to the bond amount if the contractor defaults.

We’ve been fortunate to witness the peace of mind that Bid Bonds provide, ensuring projects proceed without unnecessary delays or risks.

Learning the Application Process for Bid Bonds in Indiana

We’ve had firsthand experience with the Bid Bond application process in Indiana, and here’s a clear outline of how it works:

- Submit Financial Documents: Contractors provide financial statements, work history, and details about their upcoming project.

- Pre-Qualification: The surety company evaluates the contractor’s financial strength and project history.

- Bond Issuance: Once approved, the surety issues the Bid Bond for submission alongside the bid proposal.

From our own trials, we’ve learned that preparing thorough financial documentation and choosing a reputable surety company streamlines the application process.

Transforming Your Costs: Understanding the Price of a Surety Bid Bond

We’ve consistently observed that the cost of Surety Bid Bonds in Indiana is relatively low compared to the bond amount. Typically, it’s a percentage of the total bid amount, ranging from 1% to 5%. The price can vary depending on the contractor’s financial standing and the size of the project. Based on our experience, well-established contractors with strong credit scores can secure more favorable rates, while smaller or new companies might face slightly higher premiums.

Beyond the Ordinary: Understanding the Risk of Bid Bond Denial

We’ve come across situations in Indiana where contractors have been denied Bid Bonds, and it usually comes down to a few key reasons:

- Poor Credit History: From our dealings with Indiana contractors, we’ve noticed that a weak credit score can pose a significant obstacle when applying for a Bid Bond.

- Insufficient Financials: In our experience, contractors in Indiana who lack comprehensive financial documentation or whose business shows poor financial health often face difficulties in securing bond approval.

- Inexperience: We’ve consistently observed that Indiana contractors without a solid track record of successfully completed projects may struggle to gain approval for Bid Bonds.

Our advice to Indiana contractors is to address these potential issues upfront. Strengthening your credit, ensuring your financials are in order, and building a proven history of project success will significantly improve your chances of obtaining a Bid Bond.

Concluding Thoughts: The Vibrant Future of Bid Bonds in Indiana

We’ve come to appreciate the integral role Bid Bonds play in shaping Indiana’s construction landscape. Whether you’re a seasoned contractor or just stepping into the industry, securing a Bid Bond is vital for accessing lucrative public and private projects. From our perspective, understanding the application process and the benefits that Bid Bonds offer can transform your approach to bidding. By ensuring compliance, building trust with project owners, and minimizing financial risks, Bid Bonds remain a cornerstone of sustainable and successful construction ventures in Indiana.