You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in Georgia?

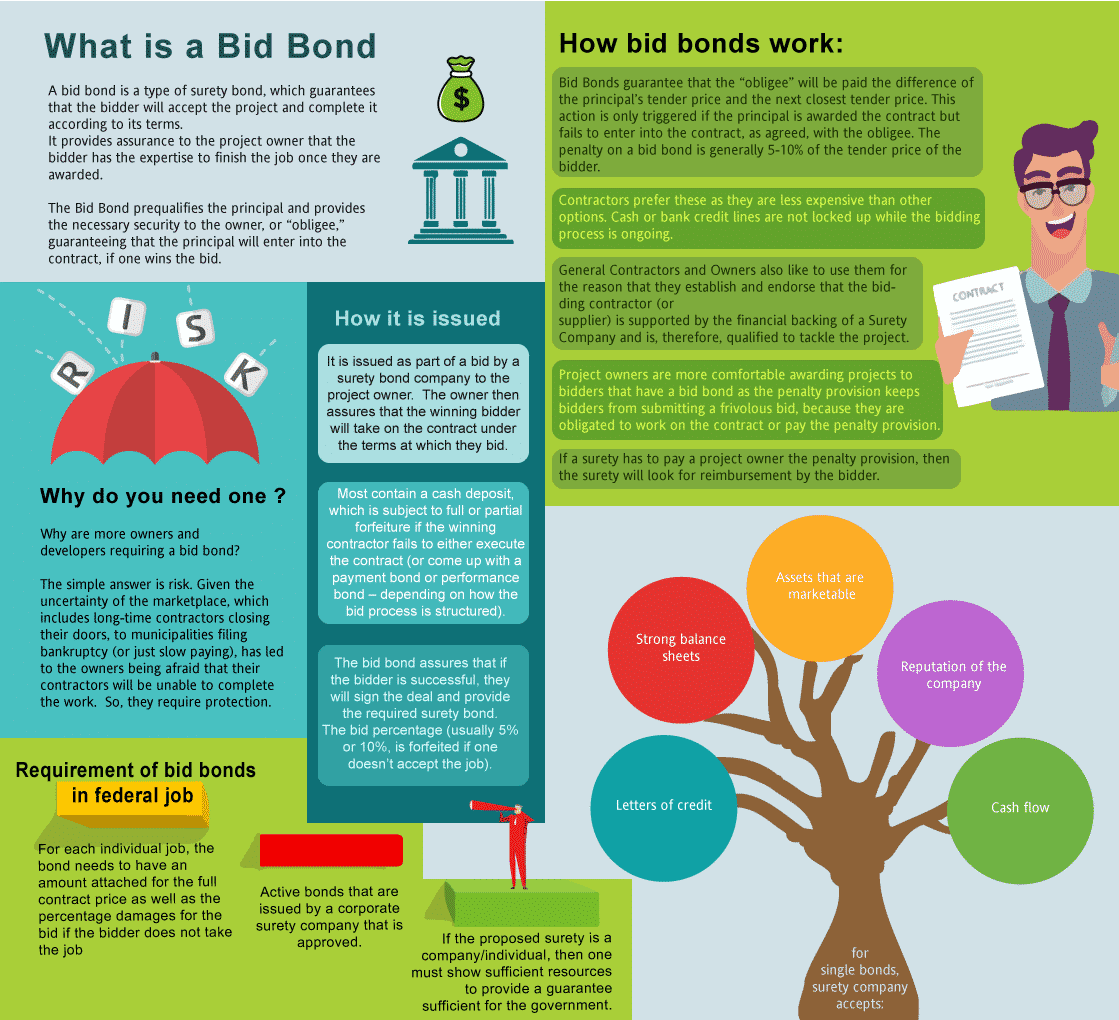

A bid bond is a type of surety bond, that guarantees that the bidder will accept the project and complete the contract according to its terms. It provides assurance to the project owner that the bidder has the expertise and wherewithal to complete the job once the bidder is selected after winning the bidding process. The simple reason is that you need one so that you get the job. However, the larger question is why are more owners/developers requiring a surety bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes long-term contractors going out of business, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to complete the work. Thus, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Georgia Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Georgia?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the contract bond if you get the job. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in GA?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Georgia. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors. See our performance bonding.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Georgia?

We make it easy to get a contract bid bond. Just click here to get our Georgia Bid Bond Application. Fill it out and then email it and the Georgia bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for surety bonds and then submit it to the surety that we believe will provide the best bid bond for your job. We have a excellent success rate in getting our clients bid bonds at the best rates possible.

Unwrapping the Core Purpose of Georgia Bid Bonds

In our experience, the core purpose of bid bonds in Georgia is to protect project owners by ensuring that contractors fulfill their bids. We’ve learned that without a bid bond, project owners risk financial setbacks if the chosen contractor fails to commit to the contract. By securing a bid bond, contractors demonstrate their reliability, making this bond an essential safeguard for public and private projects across Georgia.

Finding Georgia Bid Bonds Near You: A Complete Guide

We’ve found through experience that securing a bid bond in Georgia is relatively straightforward if you know where to look. For those wondering, “Where can I find a bid bond near me?” we’ve gathered that local agencies and online platforms provide the best options. In our observation, it’s crucial to work with licensed agents who understand the specific regulations governing Georgia construction projects. This ensures that the bond complies with local laws, ultimately making the process smoother and more efficient.

Spotlight on Who Typically Receives Bid Bonds in Georgia

In our professional dealings with bid bonds, we’ve come across various entities that are commonly required to obtain them. Here’s a quick enumeration of the top contenders:

- Licensed Contractors: Contractors aiming to win public or private projects in Georgia.

- Subcontractors: Subcontractors handling substantial parts of a larger contract are often required to have bid bonds.

- Government Project Bidders: We’ve consistently observed that government-funded projects require bid bonds without exception. From our perspective, understanding who qualifies for bid bonds is key to ensuring success in bidding for Georgia’s projects.

We provide bid bonds in each of the following counties:

Appling

Atkinson

Bacon

Baker

Baldwin

Banks

Barrow

Bartow

Ben Hill

Berrien

Bibb

Bleckley

Brantley

Brooks

Bryan

Bulloch

Burke

Butts

Calhoun

Camden

Candler

Carroll

Catoosa

Charlton

Chatham

Chattahoochee

Chattooga

Cherokee

Clarke

Clay

Clayton

Clinch

Cobb

Coffee

Colquitt

Columbia

Cook

Coweta

Crawford

Crisp

Dade

Dawson

De Kalb

Decatur

Dodge

Dooly

Dougherty

Douglas

Early

Echols

Effingham

Elbert

Emanuel

Evans

Fannin

Fayette

Floyd

Forsyth

Franklin

Fulton

Gilmer

Glascock

Glynn

Gordon

Grady

Greene

Gwinnett

Habersham

Hall

Hancock

Haralson

Harris

Hart

Heard

Henry

Houston

Irwin

Jackson

Jasper

Jeff Davis

Jefferson

Jenkins

Johnson

Jones

Lamar

Lanier

Laurens

Lee

Liberty

Lincoln

Long

Lowndes

Lumpkin

Macon

Madison

Marion

McDuffie

McIntosh

Meriwether

Miller

Mitchell

Monroe

Montgomery

Morgan

Murray

Muscogee

Newton

Oconee

Oglethorpe

Paulding

Peach

Pickens

Pierce

Pike

Polk

Pulaski

Putnam

Quitman

Rabun

Randolph

Richmond

Rockdale

Schley

Screven

Seminole

Spalding

Stephens

Stewart

Sumter

Talbot

Taliaferro

Tattnall

Taylor

Telfair

Terrell

Thomas

Tift

Toombs

Towns

Treutlen

Troup

Turner

Twiggs

Union

Upson

Walker

Walton

Ware

Warren

Washington

Wayne

Webster

Wheeler

White

Whitfield

Wilcox

Wilkes

Wilkinson

Worth

And Cities:

Atlanta

Savannah

Marietta

Athens

Augusta

Alpharetta

Macon

Decatur

Lawrenceville

Stone Mountain

Kennesaw

See our Hawaii bid bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Best Practices for Securing Bid Bonds in Georgia: Tips and Tricks

We’ve gained in-depth insight into best practices that contractors should follow when securing bid bonds in Georgia:

- Maintain Strong Financial Health: We’ve observed that contractors with solid financials get better approval odds.

- Pre-qualify with Sureties: We’ve often noticed that pre-qualification speeds up the process for future bids.

- Understand Georgia’s Local Laws: From our experience, local regulations can impact the approval process.

- Ensure Competitive Bids: We’ve found that bidding within your means improves the likelihood of securing a bond. By following these tips and tricks, contractors can streamline their bid bond applications and ensure a higher success rate in Georgia.

What Is a Surety Bid Bond? An In-Depth Unveiling

We’ve often noticed confusion around what a surety bid bond actually entails, so let’s unwrap it. A surety bid bond is a three-party agreement between the contractor, the project owner, and the surety company. We’ve come to understand that this bond ensures the contractor is serious about fulfilling the bid. The surety stands in to cover the costs if the contractor backs out, and we’ve found that this provides immense peace of mind to project owners in Georgia.

How Bid Bonds Work in Georgia: A Step-by-Step Guide

We’ve seen firsthand how bid bonds operate, especially in Georgia’s construction landscape. Here’s a detailed breakdown:

- Bid Submission: The contractor submits a bid bond along with their proposal.

- Owner’s Selection: If chosen, the contractor enters into the contract, backed by performance bonds.

- Claiming the Bond: If the contractor backs out, the project owner can reach out and claim the bond. We’ve observed that this process runs smoothly when contractors are well-versed in Georgia’s rules, helping project owners avoid financial losses.

The Surety Bid Bond Application in Georgia: What You Need to Know

We’ve been involved in many Georgia-based bid bond applications, and the process usually involves several steps:

- Financial Documentation: Contractors must present financial statements and work history.

- Underwriting: We’ve seen that the surety company assesses the contractor’s credibility through these documents.

- Approval and Bond Issuance: Once approved, the contractor receives the bid bond. In our observation, the process goes more smoothly for those who maintain a good relationship with their surety and have a solid track record.

The Price of Bid Bonds in Georgia: A Revealing Look

We’ve found that the cost of a bid bond in Georgia typically ranges from 1% to 5% of the total bid. Contractors with stronger financial backing tend to receive lower rates, while those with higher risks might see an increase. Based on our experience, securing competitive rates involves shopping around and working with experienced surety agents who understand the Georgia market.

Can You Be Denied a Bid Bond in Georgia? Reasons to Consider

We’ve encountered situations where contractors in Georgia were denied bid bonds. Here are the primary reasons we’ve seen:

- Poor Financial Standing: Contractors with unstable finances struggle to secure bonds.

- Inadequate Experience: We’ve often noticed that lack of experience in managing large-scale projects is a major barrier.

- Legal Issues: From our experience, unresolved lawsuits or compliance problems can lead to bond denial in Georgia. By addressing these common issues, contractors can increase their chances of obtaining a bid bond successfully.

Concluding Thoughts: Securing Success with Bid Bonds in Georgia

We’ve realized through our work that bid bonds are essential for contractors aiming to win competitive projects in Georgia. By following best practices and understanding the local landscape, contractors can position themselves for success. Our experience tells us that being proactive about securing bid bonds—and working with reliable sureties—offers both financial protection and a clear path to project success.

Learn more on bid bond example.