You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

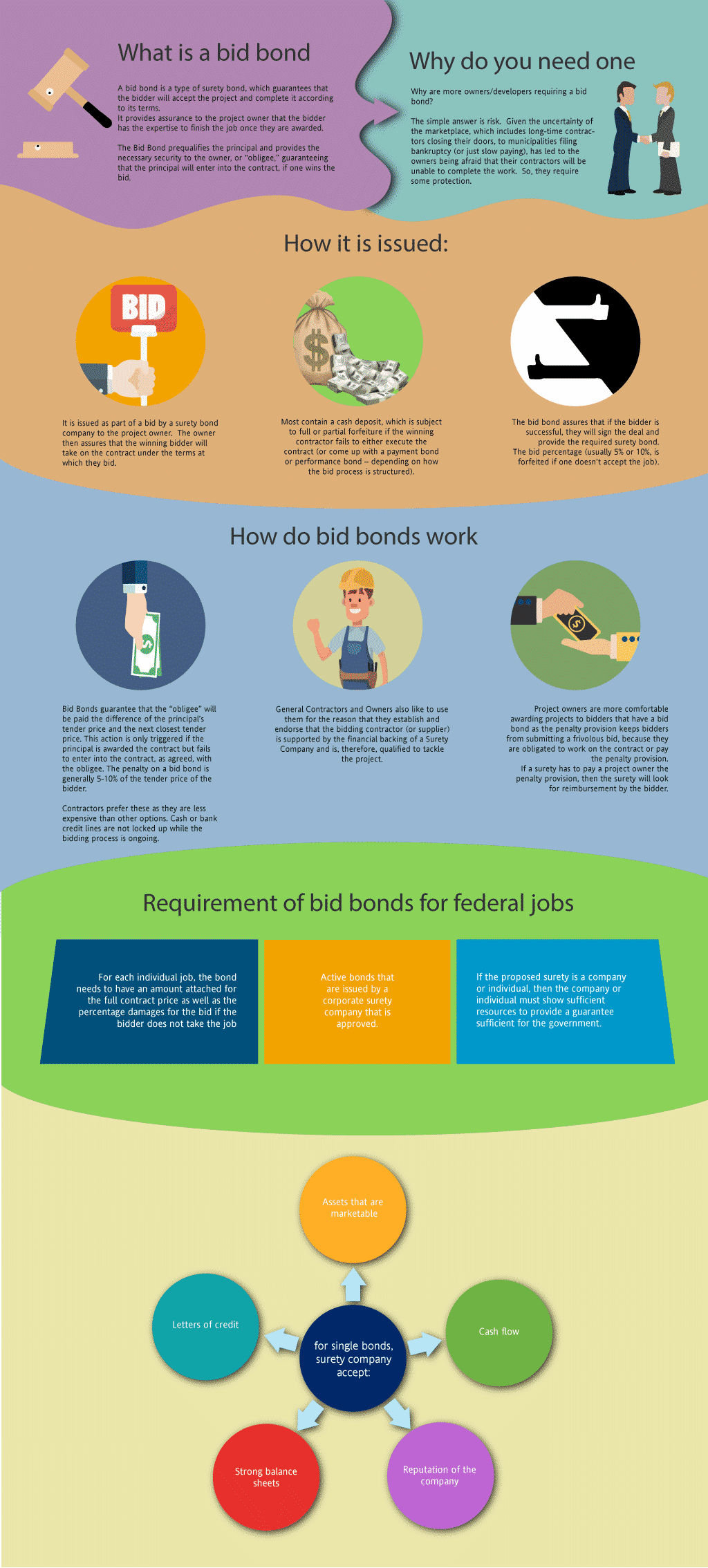

What is a Bid Bond in Delaware?

A bid bond is a type of surety bond, that guarantees that the bidder will enter into the agreement and complete it according to its terms. The bid bond provides assurance to the project owner that the bidder has the expertise and ability to finish the job once the bidder is selected after the bidding process. The basic reason is that you need one in order to get the job. But the larger question is why are more owners/developers requiring a bid bond in the first place? The basic answer is risk. Given the uncertainty of the marketplace, which includes long-time contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to finish the work. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Delaware Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Delaware?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the P&P bond if you win the contract. The cost of a surety bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in DE?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Delaware. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors. See our Swiftbonds Performance Bond Cost page for more.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Delaware?

We make it easy to get a contract bid bond. Just click here to get our Delaware Bid Bond Application. Fill it out and then email it and the Delaware bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for surety bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a great success rate in getting our clients surety bid bonds at the best rates possible.

Unboxing Delaware Bid Bonds: What You Need to Know

From our perspective, Delaware bid bonds are a crucial financial tool that enhances trust between contractors and project owners. A bid bond guarantees that the contractor will uphold the terms of their bid if awarded the project. We've found that these bonds help ensure that only serious, financially capable bidders participate, thus protecting the project's financial stability. Unboxing the essential aspects of bid bonds is key to understanding how they can secure a project from start to finish.

Discovering the Best Spots to Find a Delaware Bid Bond

We’ve noticed that finding the right provider for a bid bond in Delaware is key to a smooth bidding process. The best spots to look include local surety companies and agencies with a solid track record in Delaware’s construction industry. By working with local experts, you can unleash the potential for better rates and a more streamlined experience, ensuring your bid bond application is handled with care and expertise.

Key Beneficiaries of Delaware Bid Bonds: Who Really Gains?

We've discovered that Delaware bid bonds benefit three main groups:

- Project Owners – These bonds offer security, ensuring that contractors are committed to their bids.

- Contractors – Securing a bid bond enhances a contractor's credibility, showcasing their financial health and commitment.

- Surety Companies – Sureties play a key role in backing the contractor, providing financial support if issues arise. In our experience, these bonds create a win-win situation for all parties involved in the construction journey.

We provide bid bonds in each of the following counties:

Kent

New Castle

Sussex

And Cities:

Delaware City

Wilmington

Newark

Dover

Smyrna

Middletown

Lewes

Milford

New Castle

Elsmere

Seaford

See our Florida bid bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Unleashing Practical Advice for Delaware Bid Bonds

We’ve often noticed that understanding best practices is essential when thinking about bid bonds. Here are some key tips for a successful bid bond journey:

- Know the Requirements – Each project in Delaware may have unique specifications.

- Maintain Strong Financials – Surety companies spot red flags in financials quickly.

- Double-Check Documentation – Incomplete paperwork can delay or derail the application process.

- Understand Bond Limits – We’ve learned that some bonds have specific coverage limits based on the project’s size.

What is a Surety Bid Bond? Unleashing the Facts

In our observation, a surety bid bond enhances trust by acting as a financial guarantee that the contractor will fulfill their bid obligations. What we’ve discovered is that surety bonds play an essential role in Delaware's construction sector, especially for public works projects. These bonds ensure that the contractor is backed by a surety, adding an extra layer of financial protection for the project owner.

How Surety Bid Bonds Work: Unboxing the Process in Delaware

We’ve been able to spot the key steps that make surety bid bonds work effectively in Delaware:

- Bid Submission – The contractor submits their bid with a bond attached, signaling their commitment.

- Surety’s Role – We’ve noticed that the surety company reviews and approves the bond, ensuring the contractor meets all financial requirements.

- Project Award – If the bid is successful, the bond ensures the contractor follows through with their responsibilities.

The Application Journey for Delaware Surety Bid Bonds: Best Practices

In our professional experience, applying for a surety bid bond in Delaware requires attention to detail and best practices:

- Solid Financial Statements – Sureties require detailed financial records.

- Strong Credit Score – We’ve found that a higher credit score enhances your chances of approval.

- Proof of Work History – A proven track record can be a deciding factor for surety companies.

- Clear Bonding Capacity – We’ve come across situations where ensuring your bonding capacity matches the project size is critical for approval.

Key Facts About the Price of Delaware Surety Bid Bonds

We’ve gained insight into the cost structure of Delaware bid bonds, typically ranging from 1% to 3% of the total bid amount. From our own work, we’ve learned that the price may vary based on the contractor's credit score and the size of the project. Contractors with higher credit ratings often unlock better rates, making it vital to maintain solid financial health.

Top Reasons You Could Be Denied a Bid Bond in Delaware

We’ve discovered through trial and error the main reasons bid bond applications are denied in Delaware:

- Poor Credit – A weak credit score can raise red flags.

- Incomplete Financials – Sureties want full transparency, and missing documents can halt the process.

- High-Risk Projects – Some high-risk projects may make it difficult to secure a bond. We've come to the conclusion that preparing thoroughly before applying can help avoid these pitfalls.

Concluding Your Delaware Bid Bond Journey: Key Takeaways

We’ve come to recognize that Delaware bid bonds are an essential part of the construction journey. They offer protection for project owners and credibility for contractors, ultimately fostering a secure and efficient bidding process. Based on our experience, ensuring your financial standing, understanding the bond’s scope, and following best practices will help unleash the full potential of bid bonds in Delaware.