You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in Connecticut?

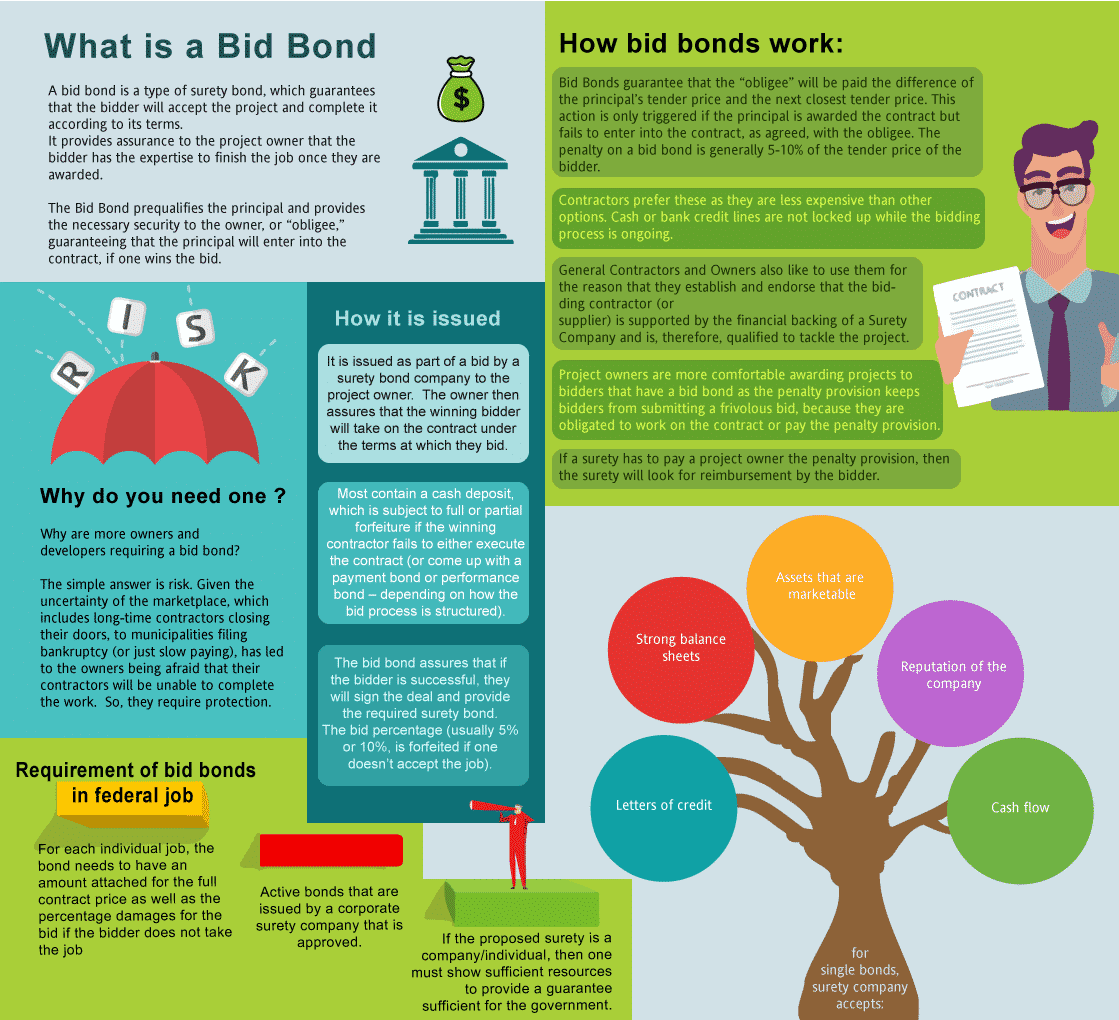

A bid bond is a type of surety bond, which guarantees that the bidder will accept the project and complete it according to its terms. It provides assurance to the project owner that the bidder has the knowhow and capability to finish the job once the bidder is selected after winning the bid. The basic reason is that you need one so that you get the contract. But the bigger question is why are more owners/developers requiring a surety bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes long-term contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Connecticut Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Connecticut?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the surety bond if you win the contract. The cost of a P&P bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a contract bond.

How much do bonds cost in CT?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Connecticut. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Connecticut?

We make it easy to get a contract bid bond. Just click here to get our Connecticut Bid Bond Application. Fill it out and then email it and the Connecticut bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review all application for surety bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a excellent success rate in getting our clients bid bonds at the very best rates possible.

An In-Depth Look at Connecticut Bid Bonds: Key Facts You Need to Know

Demystifying Connecticut Bid Bonds: The Core Truth

From our perspective, a Connecticut bid bond is at the core of ensuring that contractors bidding on a project are serious about their intent to follow through if awarded the contract. This type of surety bond provides financial assurance to the project owner that the winning bidder will undertake the project under the terms submitted in their bid. We’ve consistently found that bid bonds are vital in protecting project owners from financial loss if a contractor fails to honor their bid.

Streamline Your Search: Discover Bid Bonds Near You

We’ve often noticed that streamlining the search for a local provider of bid bonds in Connecticut is crucial. There are multiple surety companies and bond agencies across the state specializing in bid bonds. In our experience, working with providers familiar with Connecticut’s specific bonding requirements can make the journey smoother and more efficient.

Who Benefits from Bid Bonds in Connecticut? Key Parties Involved

We’ve come to understand that there are three core beneficiaries of bid bonds in Connecticut:

- The Project Owner – Protected from financial loss if the winning bidder backs out.

- The Contractor – Gains credibility and enhances the likelihood of selection.

- The Surety Company – Provides the financial backing that guarantees the contractor’s promise.

In our dealings with bid bonds in Connecticut, we’ve found that these three entities play pivotal roles in ensuring a secure and reliable bidding process.

We provide bid bonds in each of the following counties:

Fairfield

Hartford

Litchfield

Middlesex

New Haven

New London

Tolland

Windham

And Cities:

Hartford

New Haven

Stamford

Bridgeport

Greenwich

Norwalk

Danbury

Waterbury

Fairfield

Milford

Westport

See our Delaware Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Practical Advice to Streamline Your Bid Bond Journey

In our observation, here are some key tips to streamline your bid bond application journey:

- Organize Required Documentation: We’ve found that having your financials and past project records ready is crucial.

- Choose a Reputable Bond Agency: Based on our experience, working with seasoned bond agents simplifies the process.

- Familiarize Yourself with Connecticut Laws: We’ve noticed that understanding local regulations can prevent future issues.

- Maintain Clear Communication: Transparency with all parties involved prevents delays and misunderstandings.

Demystifying the Surety Bid Bond: Key Truths Revealed

In our view, a surety bid bond is a tripartite agreement that serves as a financial guarantee between the project owner, the contractor, and the surety company. We’ve come across that the surety company promises to ensure the contractor’s performance, giving project owners peace of mind.

How Does a Bid Bond Work in Connecticut? Key Aspects Explored

We’ve consistently observed that the bid bond process in Connecticut follows this journey:

- Bidding Stage: Contractors submit a bid and a bid bond to the project owner.

- Contract Evaluation: If selected, the contractor is required to sign the contract and provide performance and payment bonds.

- Surety’s Role: If the contractor fails to proceed, the surety compensates the project owner.

From what we’ve seen, this process creates a robust and trustworthy bidding environment in Connecticut.

The Application Journey for a Bid Bond in Connecticut: Core Steps

We’ve been fortunate to gain insight into the key steps involved in applying for a bid bond in Connecticut:

- Preliminary Review: Surety companies evaluate the contractor’s financial health and experience.

- Documentation Submission: Contractors must provide financial records, work history, and project specifics.

- Approval and Issuance: Upon review, the surety issues the bond to accompany the bid.

We’ve found that thorough preparation and accuracy can streamline this journey, ensuring faster approvals.

Uncovering the Price: What Does a Bid Bond Cost in Connecticut?

What we’ve discovered is that the cost of a bid bond in Connecticut typically depends on the project’s value and the contractor’s financial standing. On average, the bond costs range between 1% to 5% of the total project value. We’ve seen firsthand that larger projects often have lower percentage rates due to the financial scale involved.

Is There a Chance of Denial? Key Reasons Unveiled

We’ve often noticed that bid bond applications can be denied for several key reasons:

- Credit Issues: Contractors with poor credit might face difficulties in securing a bond.

- Lack of Financial Strength: In our view, financial health is a key determinant for surety companies.

- Insufficient Experience: We’ve noticed that contractors attempting projects far beyond their experience may be denied.

We’ve come to realize that strengthening financials and building a solid track record significantly improves the chances of approval.

Wrapping Up: Concluding Thoughts on Bid Bonds in Connecticut

As we wrap up this in-depth exploration, we’ve concluded that Connecticut bid bonds serve as a crucial tool for ensuring a trustworthy and secure bidding process. What we’ve consistently observed is that these bonds protect project owners and help contractors establish credibility. With the right preparation and collaboration with a reputable surety, navigating the journey of bid bonds in Connecticut can be a streamlined and efficient experience.