For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

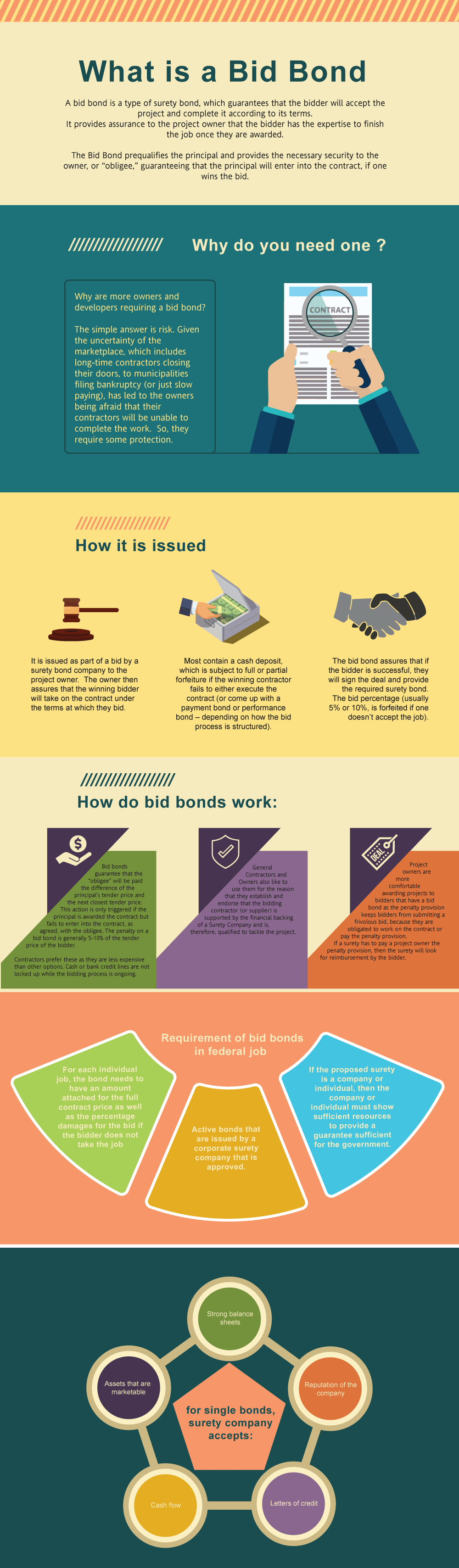

What is a Bid Bond in Arizona?

A bid bond is a type of surety bond, that guarantees that the bidder will accept the project and complete the contract according to its terms. The bid bond provides assurance to the project owner that the bidder has the expertise and wherewithal to finish the job once the bidder is selected after winning the bidding process. The basic reason is that you need one in order to get the work. However, the larger question is why are more owners/developers requiring a bid bond? The simply explanation is risk. Given the uncertainty of the marketplace, which includes experienced contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to complete the job. Thus, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Arizona Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Arizona?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you win the contract. The cost of a P&P bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract if awarded.

How much do bonds cost in AZ?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Arizona. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors. See our Performance Bond Cost page for more.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Arizona?

We make it easy to get a contract bid bond. Just click here to get our Arizona Bid Bond Application. Fill it out and then email it and the Arizona bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We thoroughly review each application for bid bonds and then submit it to the surety that we believe will provide the best surety bid bond for your company. We have a very high success rate in getting our clients bid and P&P bonds at the best rates possible.

Decoding Arizona Bid Bonds: A Key Element in Securing Contracts

From our perspective, bid bonds are a critical component of the contracting process in Arizona. A bid bond is a surety bond that protects project owners by ensuring that the contractor will follow through with their bid and obtain performance and payment bonds if awarded the contract. Bid bonds are especially relevant in public sector projects, where they guarantee that bidders have the financial backing to complete the work. In Arizona, the use of bid bonds is widespread due to the state’s growing infrastructure and development projects.

How to Locate a Reliable Bid Bond Provider Near You

In our line of work, we’ve often noticed that finding a trustworthy bid bond provider can make a significant difference in the outcome of a project. Arizona is home to numerous surety bond companies, many of which specialize in bid bonds. By searching online or consulting with local contractors, you can find providers that offer competitive rates and reliable service. It’s essential to work with a company that understands the unique requirements of the Arizona construction market, ensuring you receive the most suitable bond for your project.

Who Benefits from Bid Bonds in Arizona? Key Stakeholders Explained

We’ve learned that bid bonds are not only beneficial for project owners but also for contractors and subcontractors. Here’s a breakdown of who benefits:

- Project Owners: They are protected against non-performance by ensuring that contractors are financially capable.

- Contractors: By having a bid bond, they demonstrate their commitment to the project, making their bids more credible.

- Subcontractors and Suppliers: When bid bonds are in place, there’s a sense of security that the contractor will proceed with the project, offering assurance to all parties involved.

We provide bid bonds in each of the following counties:

Apache

Cochise

Coconino

Gila

Graham

Greenlee

La Paz

Maricopa

Mohave

Navajo

Pima

Pinal

Santa Cruz

Yavapai

Yuma

And Cities:

Phoenix

Tucson

Scottsdale

Mesa

Tempe

Sedona

Chandler

Flagstaff

Glendale

Gilbert

Prescott

Yuma

See our Arkansas bid bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Helpful Advice for Navigating Arizona Bid Bonds

Based on our experience, there are several practical considerations when dealing with bid bonds in Arizona:

- Understand State-Specific Requirements: Each state may have its own regulations regarding bid bonds. In Arizona, it’s important to ensure your bid bond complies with local laws.

- Work With Reputable Sureties: Partnering with a reliable surety provider can streamline the process and prevent potential delays in contract execution.

- Plan Ahead: We’ve often found that applying for a bid bond well in advance of submitting your bid can help avoid last-minute complications.

The Fundamentals of a Surety Bid Bond: What It Entails

In our observation, a surety bid bond is essentially a three-party agreement involving the project owner, the contractor (or principal), and the surety company. The surety guarantees the project owner that the contractor will not back out of the project once the bid is accepted. If the contractor fails to meet their obligations, the surety covers the difference, ensuring the project owner isn’t left in a vulnerable position.

A Closer Look: How Does a Surety Bid Bond Work in Arizona?

We’ve consistently found that understanding how a surety bid bond works is key to successful project bidding. Here’s how it breaks down:

- Bid Submission: Contractors submit their bids along with the bid bond to the project owner.

- Project Award: If awarded the contract, the contractor must accept the job and provide performance bonds.

- Surety’s Role: Should the contractor fail to accept the contract, the surety steps in to cover the difference, protecting the project owner from financial loss.

Applying for a Surety Bid Bond in Arizona: What You Need to Know

We’ve come across various factors involved in applying for a surety bid bond in Arizona:

- Complete the Application: Provide detailed information about your financial standing, project history, and any prior bond experience.

- Submit Financials: Financial stability is critical, so you’ll need to submit your company’s financial statements to the surety.

- Obtain Approval: Once your application is approved, the surety issues the bid bond, which you can then include in your bid submission.

The Cost of a Surety Bid Bond: What to Expect

From what we’ve seen, the cost of a surety bid bond is relatively affordable, typically ranging from 1% to 3% of the project bid amount. The price depends on several factors, including the contractor’s financial standing, the project’s scope, and the surety provider’s risk assessment. In Arizona, with its booming construction sector, the competition among surety providers helps keep costs competitive for contractors.

Potential Reasons for Bid Bond Denial: Avoiding Pitfalls

We’ve been in situations where contractors were denied a bid bond, and based on our experience, the following reasons are common:

- Poor Credit History

- Lack of Financial Stability

- Inadequate Project Experience

- Non-compliance with Arizona Regulations

- Unreliable Surety Provider

Avoiding these pitfalls can significantly increase your chances of approval when applying for a bid bond.

Concluding Thoughts: Why Bid Bonds Are Essential for Arizona Contractors

We’ve come to appreciate the importance of bid bonds in ensuring successful project execution in Arizona. These bonds not only safeguard project owners but also provide contractors with credibility in competitive markets. By working with a reputable surety, understanding state-specific requirements, and applying practical advice, Arizona contractors can position themselves for success in securing large-scale contracts. Whether you’re new to the process or a seasoned contractor, bid bonds remain an essential aspect of your business operations in Arizona’s vibrant construction industry.