You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

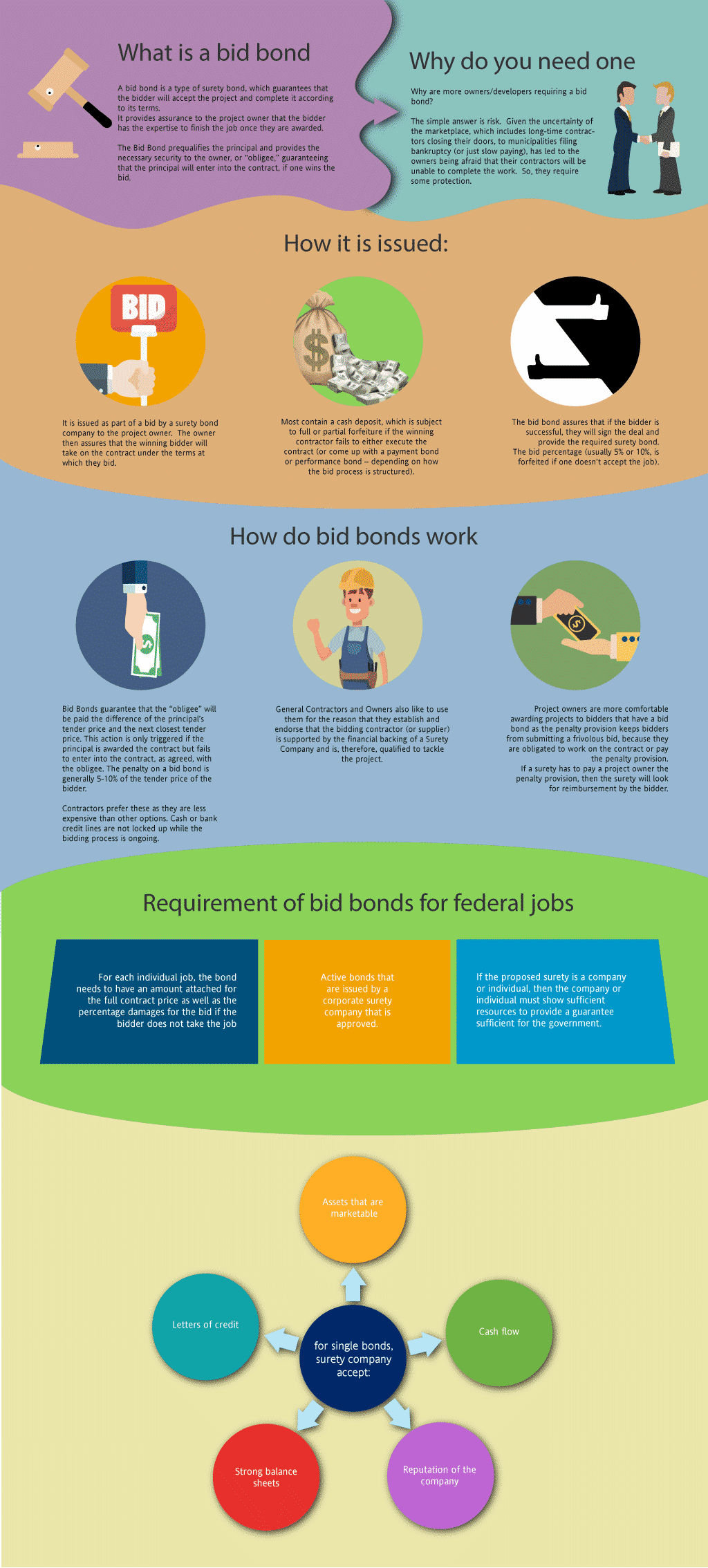

What is a Bid Bond in Alaska?

A bid bond is a type of surety bond, which guarantees that the bidder will accept the contract and complete the contract according to its terms. It provides assurance to the project owner that the bidder has the knowhow and ability to complete the job once you are selected after winning the bidding process. The basic reason is that you need one so that you get the contract. However, the bigger question is why are more owners/developers requiring a bid bond in the first place? The basic answer is risk. Given the uncertainty of the marketplace, which includes long-time contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to finish the work. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Alaska Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Alaska?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the P&P bond if you win the contract. The cost of a P&P bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract (rare).

How much do bonds cost in AK?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Alaska. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors. See our performance surety bond page for more.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Alaska?

We make it easy to get a contract bid bond. Just click here to get our Alaska Bid Bond Application. Fill it out and then email it and the Alaska bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We review all application for bid and P&P bonds and then submit it to the surety that we believe will provide the best bid and P&P bond for your contract. We have a high success rate in getting our clients surety bonds at the very best rates possible.

Alaska Bid Bonds: Your Key to a Successful Project Proposal

From our experience, Alaska Bid Bonds play a critical role in the world of public and private contracting. These bonds guarantee that a contractor bidding on a project will honor the terms of the contract if selected. Essentially, it’s a safeguard for project owners, ensuring that if the bidder backs out, financial compensation will be provided. Without a bid bond, a contractor’s proposal may not even be considered, particularly in high-stakes projects across Alaska.

Locating the Right Bid Bond Provider in Alaska

We’ve often found that finding the right bid bond provider is as essential as securing the bond itself. Alaska has a wide range of surety companies that specialize in these bonds, and understanding the nuances of local providers can make a significant difference in the application process. From our perspective, it's always best to work with a company that understands Alaska's unique legal landscape and project requirements.

Key Considerations When Choosing a Bid Bond Provider

When choosing a bid bond provider, it's important to keep the following considerations in mind:

- Experience with Local Projects

Look for a provider that has experience handling projects specific to Alaska. Whether it's public works or private construction, a company familiar with local regulations can make the bonding process smoother. - Financial Stability

Providers with strong financial backing are essential, as they ensure your bid bond will be issued promptly without any concerns about defaulting. - Customer Service

Responsive and knowledgeable customer support can make a world of difference, especially when navigating the complexities of bid bonds. You want a provider who will guide you through every step. - Reputation and Reviews

It’s important to check reviews, ask for references, or get recommendations from industry peers to ensure the provider is trustworthy and dependable.

How to Find the Right Provider

Here are some strategies for locating a reliable bid bond provider:

- Get Recommendations

Speak with other contractors or project managers in Alaska. From our perspective, word-of-mouth recommendations can often point you to reputable providers. - Online Research

Use online reviews and forums to gauge the reputation of various providers. Look for patterns in feedback regarding service quality, ease of application, and financial stability. - Consult Local Industry Associations

Reaching out to groups like the Associated General Contractors (AGC) of Alaska can help you find vetted and reliable surety companies. - Compare Rates and Services

We’ve noticed that comparing quotes and services from different providers is crucial. Not all surety companies offer the same terms, so it’s beneficial to shop around and ensure you're getting the best deal for your specific project.

Who is Responsible for Obtaining the Bid Bond?

In our professional life, we’ve noticed that obtaining a bid bond typically falls on the contractor. However, multiple parties may be involved in the process:

- Contractor – The main party responsible for securing the bond.

- Surety Company – Issues the bond and guarantees the contractor's commitment.

- Obligee (Project Owner) – The recipient of the bond, typically a government entity or project owner.

Each plays a vital role in ensuring the bond serves its purpose. We’ve encountered situations where collaboration between these parties greatly simplified the process.

We provide bid bonds in each of the following counties:

Aleutians East

Aleutians West

Anchorage

Bethel

Bristol Bay

Denali

Dillingham

Fairbanks North Star

Haines

Juneau

Kenai Peninsula

Ketchikan Gateway

Kodiak Island

Lake And Peninsula

Matanuska-Susitna

Nome

North Slope

Northwest Arctic

Prince of Wales-Outer Ketchikan

Sitka

Skagway

Southeast Fairbanks

Valdez-Cordova

Wade Hampton

Wrangell

Yakutat

And Cities:

Anchorage

Juneau

See our Arizona bid bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Key Strategies and Insider Tips for Securing a Bid Bond with Confidence

We’ve often worked on bid bonds, and here are a few key considerations when applying for one:

- Understand the Requirements: We’ve learned that reading the fine print of each project’s bond requirements is crucial.

- Choose the Right Surety: We’ve observed that a good relationship with a surety can expedite the process.

- Prepare Your Financials: In our observation, strong financials increase your chances of approval.

By keeping these points in mind, we’ve found that contractors can streamline the bid bond application process.

Decoding the Surety Bid Bond

What we’ve experienced is that a surety bid bond is more than just a financial instrument—it’s a guarantee. The surety company promises that if the contractor fails to execute the contract, the project owner will not bear financial loss. In our dealings with contractors, we’ve consistently observed that having a reliable surety ensures trust between all parties involved.

How a Surety Bid Bond Functions in Alaska

We’ve come to understand that surety bid bonds operate in a systematic way:

- Prequalification: We’ve noticed that sureties require contractors to undergo a financial review.

- Issuance: The surety issues the bond after prequalification.

- Guarantee: In the event the contractor defaults, the surety compensates the project owner.

Our experience tells us that these steps are crucial for both contractors and project owners to protect their investments.

The Simple Process of Applying for a Surety Bid Bond

We’ve been able to determine that applying for a surety bid bond can be straightforward when approached methodically. Here’s how:

- Submit Financial Documentation: Based on our experience, this is the most critical part of the application.

- Underwriting Process: The surety evaluates the contractor’s qualifications.

- Approval and Issuance: Once approved, the bond is issued to the contractor.

We’ve consistently found that having well-organized financials speeds up the approval process.

How Much Does a Surety Bid Bond Cost?

We’ve come across varying prices for surety bid bonds in Alaska. Generally, the cost is a small percentage of the contract bid, often ranging from 1% to 5%. We’ve learned that this cost can fluctuate depending on the contractor’s financial standing, the size of the project, and the surety’s assessment of risk.

Can Your Bid Bond Application Be Denied?

In our dealings with bid bonds, we’ve encountered situations where applications are denied. Denial typically happens due to poor credit, insufficient financial backing, or previous defaults. In our observation, it’s important to maintain strong financial records and develop a relationship with a surety to improve your chances of approval.

Final Thoughts on Bid Bonds in Alaska

We’ve come to the conclusion that bid bonds are essential for contractors in Alaska who want to be considered for large-scale projects. Whether you’re a seasoned contractor or new to the field, understanding the bid bond process can significantly impact your ability to secure projects. We’ve had firsthand experience with contractors who’ve leveraged these bonds to enhance their professional credibility and win prestigious contracts.

By following the practical advice and insights we’ve shared, navigating Alaska’s bid bond landscape becomes a more manageable and successful endeavor.

Learn more about the state of Alaska bids.