How Much Does a Performance Bond Cost?

The cost of a performance surety bond can vary by the type of bond and the client, but a good rule of thumb is that it costs one to three percent (1-3%) of the contractual amount. The cost of a performance bond may go up by 1.5% to 2% on riskier contracts, or down even lower if your financial rating is stellar. The financial strength and credit worthiness of the principal are major considerations in the cost of the bond. For our small contractor bonds (those that are <$1,000,000) three percent (3%) is a pretty good rule to follow. For larger bonds and good credit risk clients, we spend a considerable amount of time trying to drive the price down as a percentage of the total job cost. For a $250,000 project a 3% fee would be $7,500.

Performance Bond Cost Calculator (Bonds Under $1,000,000)

** Please note that the Performance Bond Calculator is just an estimate. We consistently get our clients lower rates through underwriting, etc.

Or you Can download our Express Performance Bond Application (click to download form)

Complete the form and email to [email protected]

- Include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results (i.e., bid tabs) if you have them

Last Updated: March, 2024

- The cost of the bond is determined based on the amount of the contract. Without going through the underwriting process, it is difficult to provide a specific cost for the performance bond unless you have an extensive record that can be used to justify the cost.

- As a good rule of thumb, most preferred contractors get rates between One to Three Percent (1-3%) of the value of the contract with riskier contractors getting additional costs of 1-1.5%

The bond cost goes up (and down) based on the value of the contract.

**Contractor’s Tip: be sure to build in the bond cost into any change orders!

Items That Affect the Cost of the Bond

As we stated above, the cost of the bond is based on the amount of the contract. Without going through the underwriting process, it is difficult to provide a specific cost for the performance bond unless you have a good record that we use to justify the cost. Things to take into consideration are the contractor's financial history, credit score, and financial history and credit score of the owner. If the contractor has poor credit, the bond cost can go up (say, from 3% to 4-5%). The rates can vary depending on the type of job as well, as certain jobs are deemed riskier, which increases the premium.

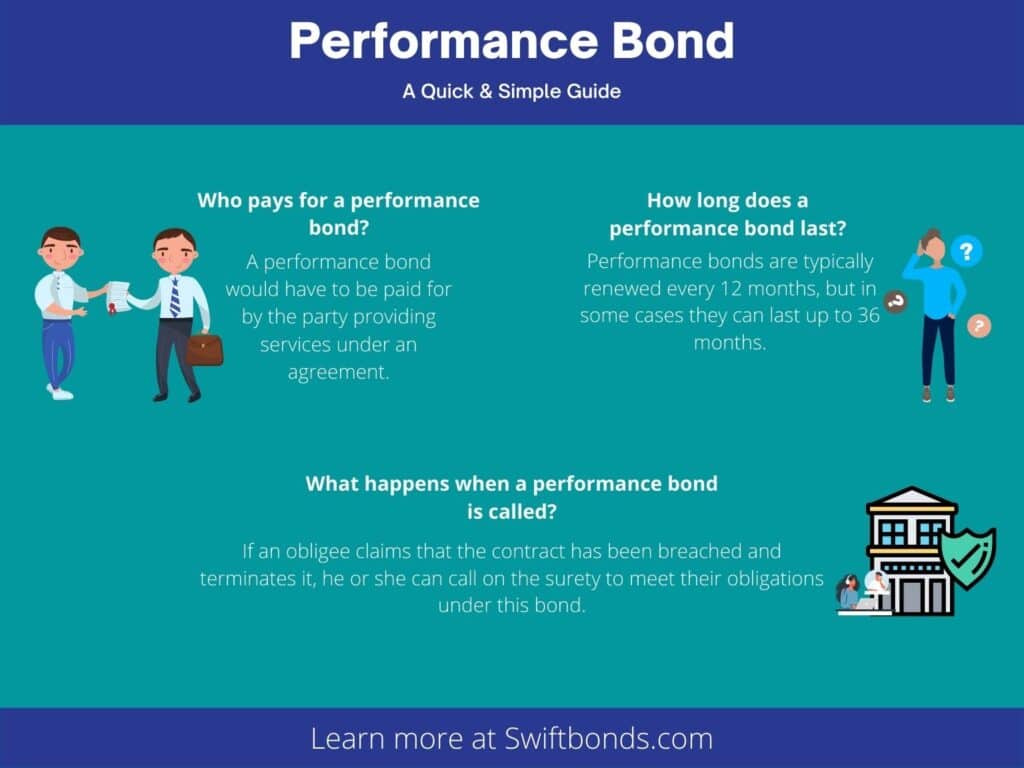

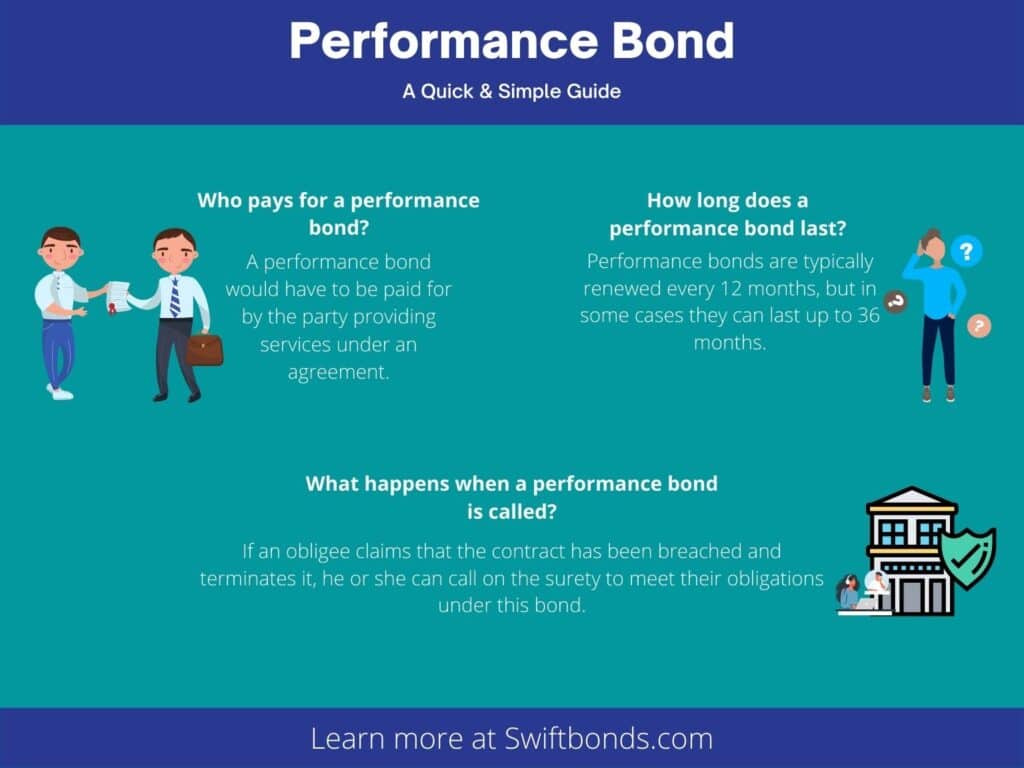

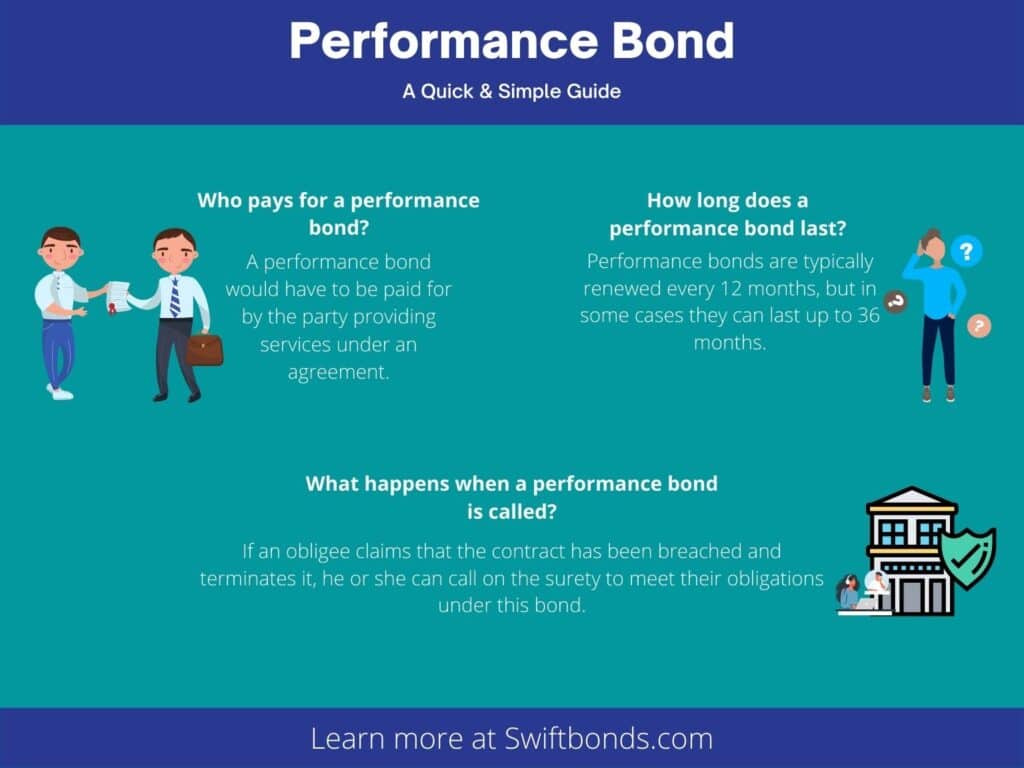

Who pays for a performance bond?

A performance bond is directly paid for by the contractor. Normally, the performance bond cost is included in the bid price by a contractor. So, it is really the owner of the project (the Obligee) that will pay for the bond (albeit indirectly) as all bidders will include the bond cost in their bid.

Benefits and Drawbacks of a Performance Bond

Benefits

- They provide assurance to the owner that the project will be completed

- They provide assurance that the work will be done timely

- They make sure that all material vendors are paid

- They ensure that all subcontractors are paid

- No liens!

Drawbacks

- There is an additional cost of 1-3%

- Sometimes the surety company will try and deny claims based on the specific terms of the contract

What is the Typical Cost of a Performance Bond? That is, the Normal Performance Bond Cost Amount Plus Fees

The cost of a performance bond usually is less than 3% of the contract price, but may rise to 4%. It can be more expensive if your credit rating isn't strong. Labor and material payment bonds are companions to the performance bond. In some cases additional fees may be charged for a surety bond. These fees can include escrow fees from a surety when they utilize an escrow company, which can be 1-1.5% on top of the bond cost, plus a one-time setup fee of $500-$750. In some cases fees are charged by agencies or brokers in some cases to supplement or replace commissions that are not generated from the bond. Other items, such as overnight mailing fees, credit report charges, etc. may be charged. Don't lose your mind over figuring how to calculate performance bond cost. Also, some people obsess on what is the cost of a performance bond, instead of focusing on the fees, as well as the job margins.

How are Performance Bonds Calculated Where the Penalty Amount is Less than the Contractual Amount?

Sometimes a performance bond is needed when the penalty amount is less than the contractual amount. For example, if the contract is $1,000,000, but the Performance Bond only covers $100,000, how do you calculate the premium? Most sureties (80-90%) will still require the premium to cover the entire contract, or 3% of $1,000,000 or $30,000. However, we do have a couple of markets that charge 7% of the penalty amount, or $7,000 ($100,000 *.07).

Conclusion – Average Cost of a Performance Bond

A good rule of thumb is that the average cost of a performance bond is around three percent (3%) of the job and it's determined by the nature of the project and your financial strength. It's a good idea not to compare your rate to someone else as their situation is likely different. Finally, it's a good idea to build that into your bid when getting a bonded job. Good luck.

How Much Does a Construction Performance Bond Cost?

How much does a Construction Performance Bond cost?

The cost of a construction performance bond is 10% or more for the duration. A 12-month period has rates as high as 12%. Longer periods will attract even higher rates due to risk, but most employers know they'll pay through increased contract price.

Construction Performance Bond Cost

The cost for a construction performance bond can vary depending on many factors, including but not limited to type of work, location, size and duration.

To find out how much a construction performance bond costs for your specific needs please contact us today!

Contact us today for more information about our services!

How do I get a performance bond?

A performance bond is necessary for many jobs so you can work with peace of mind. You need to pay a premium and interest on the amount, which will depend on your creditworthiness as well as what type of contract it is (i.e., bid). Find West Virginia Performance Bonds.

How are performance bond prices calculated?

Different rates apply to different people, so it's hard to say. But the general rule is that bonds are roughly 1-15% of what you're borrowing. So if you borrow $20,000 for five years at 3%, then your yearly interest would be about $1,500 — and also means paying back around an extra thousand over the lifetime of loan (not including any fees). It depends on how good your credit score is!

How are construction bonds calculated?

Construction Bonds can be quoted as a percentage and usually range in the 0.7 – 2.5% range, but they could go up to 3%. This is different for each bond depending on its size or other factors such as location of the project being built or availability of insurance companies willing to offer coverage at that price point.

How does a performance bond work in construction?

Performance bonds are a guarantee that the contractor will perform work according to the requirements of the construction contract. They protect an owner from having to pay for costly repairs after hiring someone else because their previous contractor defaulted on them in the middle of the project.

How long does a performance bond last?

Depending on the type of bond, you might not have to renew for 2 or 3 years. However, some bonds won't ever need renewal and others will offer rates after they're renewed depending on how long it's been since your purchase date.

Do you get your money back on a performance bond?

Yes, if you never submitted it to the Obligee/State and can send the original back, sometimes there's a full or partial refund. If after your first term and have paid for renewal terms but cancel before then end of that period- generally prorated refunds are provided. See our Wisconsin Performance Bonds.

How does a construction guarantee work?

The construction guarantee is like a letter of credit. It's just one more hoop that needs to be jumped through in the process leading up to signing off on any contract for building or remodeling work.

The majority of contracts governing these works require contractors to provide this confirmation, guaranteeing their performance undertaken during completion as agreed upon by both parties involved (owner and contractor).

What is the purpose of a construction bond?

A construction bond allows contractors to get large projects going without having the upfront cash flow. Without a construction bond, it would be difficult for a company like ours that's just starting out and needs all possible funding sources available in order to complete future ventures.

What is a performance guarantee in construction?

Performance Guarantees are not something that construction contractors often give. However, when they do offer a Performance Guarantee it is usually in order to secure the contract–so if anything goes wrong with their work or deadlines then you will be compensated accordingly. Read a Missouri Performance Bonds.

What is Project Guarantee?

Project Guarantee is a type of guarantee instrument that guarantees or surety instruments provided to or on behalf of the Partnership, which may be in the form of corporate guarantees, letters-of-credit, cash escrows and security deposits.

What are the three major types of construction bonds?

There are three major types: bid, performance and payment bonds. Firstly, let's explore how just one company decides which bond will work best for them before we dive into each individual type of bonding agreement in more detail!

Who pays for a performance bond?

A performance bond is provided by a bank or an insurance company and paid for by the party providing services. This type of agreement helps to protect against fraud in construction, real estate agency, and other industries.

Who does a performance bond protect?

The performance bond is a surety that guarantees the completion of a project by an independent contractor. It protects the client in case, unfortunately, they are not able to complete their contractual obligations. Get a Montana Performance Bonds.

When will you release a performance bond?

Generally, as long as the work is not completed on time or until any mistakes are fixed then the client can request for their money back from both parties.

How do you set a Performance Bond amount?

How do you price a Performance Bond?

The cost of a performance bond usually is less than 3% of the contract fee. However, if the debt is under $1 million, then it may run between 2%. Bonds can be even more costly depending on how credit-worthy your contractor is.

Do you need a performance bond?

Swiftbonds is the leading provider of performance bonds. We offer competitive rates and fast service, so that you can get back to your business as quickly as possible.

If you are looking for a reliable company with decades of experience in this field, then look no further than Swiftbonds! Contact us today!

Click here now to contact us.

How does a performance bond work?

A performance bond is issued by one party to contract to the other. It's meant as a sort of insurance policy, in case either side doesn't uphold their obligations under an agreement or fails to deliver on what was promised at the beginning.

What is a performance bond in construction?

The performance bond in construction is an arrangement to provide financial security for the employer if a contractor fails to perform its obligations. This provides peace of mind because it ensures that work will be completed on time and within budget, as well as providing protection against unforeseen events.

How do you fill out a performance bond?

You need to fill out a performance bond, but how? You write the name of the obligor on that line and for an amount. Sign it in front of someone who can attest you are indeed signing this document and have them notarize it as well.

Do you get your money back on a performance bond?

How do you get your money back on a performance bond? If you never submitted the bond to the Obligee/State and can send it back, then sometimes there will be some kind of refund. However if after cancelling before term 1 has passed or paying for renewal terms, this is when prorated refunds come in handy

Who issues a performance bond?

The typical performance bond issuer is a bank or an insurance company. Sellers are often required to provide one in order to reassure buyers if the commodity being sold does not arrive as expected. Here's Kansas Performance Bonds.

How long does a performance bond last?

Performance bonds are a type of surety bond. Performance bonds typically expire after one year, but not all performance bonding is equal and the duration can range from six months to two years or more depending on the project's requirements.

Should I get a performance bond?

Performance bonds are a great option for companies that want to avoid potential legal battles. It's the best way to ensure your company is safe and secure in any deals you make, while at the same time gaining new clients from bond issuers who see your company as marketable.

What are the three major types of construction bonds?

The three main types of construction bonds are bid, performance, and payment bonds. Construction bond holders get paid when the contractor finishes a project or stops paying at all!

Who pays for a performance bond?

The process can be complicated and often the contractor is required to pay out of pocket. You'll first need to obtain a bid bond before bidding on your project, then you must usually also cover some sort of premium with whatever amount they decide upon as well as interest rates (again depending on what risk level).

What happens when a performance bond is called?

A performance bond is like insurance. If the obligee declares that you are in default and terminates your contract, they can call on a surety to meet their obligations under the bonded contract.

Can a performance bond be Cancelled?

Unlike a car insurance policy, performance bonds can't be cancelled just because you lost the policy receipt. Performance bonds are required by an obligee — like a court or municipality that requires companies to carry them as condition of their license. See our Kentucky Performance Bonds.

Who pays bond cancellation?

Banks are now charging all bond sellers with a 90 day early termination charge if the seller wishes to cancel their contract before it's term is complete. However, this has not been enforced by law and there have only been two cases where courts ruled in favor of banks that terminated bonds without penalty.

How much does it cost to cancel a bond?

What are the financial implications if I cancel my bond early? If you choose to get out of your property purchase before the first year or two, most banks and bond originators will charge a 1% penalty. That means that for every $1 in outstanding balance on the contract they would subtract an additional dollar from your sales price when it is time to sell.

How does a performance guarantee work?

A performance bond can be put in place to ensure that any costs incurred as a result of the contractor's failure will not come out of your pocket. The surety company would then reimburse you, and hopefully get work done by another provider after they have been paid for their troubles!

What is a bonding rate?

A contract bond costs between 1% and 3% of the total amount. The size, experience, financial stability and reputation determine where on this range they fall at. Contractors that qualify for amounts up to $500K pay an average fee of 2%. Read our Louisiana Performance Bonds.

Where can I get a performance bond?

Performance bonds are usually issued by a bank or an insurance company. These companies act as “sureties” and provide the bond to guarantee that work will be completed on time, without any interruption in service from your contractors.

How do I get a performance bank guarantee?

To request a performance bank guarantee, the account holder contacts their bank and fills out an application that identifies the amount of and reasons for the assurance. Typical applications stipulate a specific period of time during which payment should be made or any special conditions regarding this process.

How are bond settlements calculated?

The process of calculating the amount is not complicated at all. First, you must add back any interest accrued on the clean price then multiply by face value to get your total payment. The number rounded off will be in krona and happen two business days after trade date- just as soon as it's due!

What is the meaning of performance guarantee?

A Performance Guarantee is a contractor's promise to complete the project undertaken. A bank or insurance company issues this guarantee on behalf of contractors, ensuring that they will perform as agreed in their contract with an employer. Get a Kansas Performance Bonds.

What is a reasonable guarantee fee?

A reasonable guarantee fee should be between 1 -2% of the outstanding loan balance. The amount changes yearly, and it also varies if your balance fluctuates from year to year.

What is a performance warranty?

It's when the contractor guarantees some parts of your project for overall performance. In comparison to a materials and workmanship warranty, it assigns more responsibility on contractors and is usually longer.

How to get the Best Price on a Performance Bond?

How do you price a Performance Bond?

You must make a decision when it comes to pricing your contractor's bond. The cost of the bond premium usually is less than 1% but can range between 1-3%. If your contractor has questionable credit, they may end up costing more money in order for them to secure their financial responsibility.

Do you need a performance bond?

A performance bond is a type of surety that guarantees the completion of an obligation. Performance bonds are often required for construction projects, and they can be obtained from companies like Swiftbonds.

We offer competitive rates and flexible terms so you can find the right fit for your project's needs. Our goal is to make it easy for customers to get bonded quickly without sacrificing quality or service.

Click this right now and fill out our online form!

Is it hard to get a performance bond?

In most cases, you will first need to obtain a bid or contract bond before bidding on the project. Depending on your needs and circumstances, there are many options available for surety bonds including basic performance bonding requirements that can be obtained in just one day if necessary.

Do you get your performance bond money back?

It's not all bad news for you if things don't go according to plan with a performance bond. If the obligee fails to complete their task, then your surety will step in and cover any claims or expenses related to that failure on behalf of the business.

How does a performance bond work?

A performance bond is a guarantee against failure to meet obligations under the contract or delivery on an agreed level of service. A performance bond can be issued in favor of both parties, as it acts like insurance. Read our How to fill out a Performance Bond Application?

What is the lifespan of a performance bond?

Performance bonds have varying lifespans depending on what they are for and how long it lasts. Some can last two to three years, while others might not renew at all! In some cases you can get cheaper rates when your renewal date rolls around.

Who issues a performance bond?

A performance bond is issued by banks or insurance companies. The buyer of the good guarantees that he will be reimbursed for any losses if they are not delivered on time, and this often comes with an assurance from the seller to give up their assets as security in case of non-fulfillment.

When should you release your performance bond?

Generally, as a rule of thumb, the person who issued it will have to wait until the discharge date. Usually this is either after practical completion or making good any defects in order for them to be released from their obligations. Find a How to complete a Public Performance Bond form?

What happens when a performance bond is called?

The performance bond is a form of insurance that protects the obligee in case the principal does not fulfill their obligations. If you find yourself on ‘default' status and your contract has been terminated by the obligee, they can call upon your surety to meet all claims under this agreement.

What does a performance bond cover?

A performance bond is an important security measure for a business, as it can protect against losses in the event of contractor failure. Typically this will be set at 10% to 25% of the contract value or deposit, with some additional conditions that may apply such as specific currencies and time frames.

Should I get a performance bond?

Performance Bonds are a great option for contractors that want to become more profitable. This bond secures the contractor while also giving them an opportunity to work with new companies and clients; Performance Bonds offer plenty of advantages!

How many percent is the performance bond?

The contractor agrees to a 15% performance bond, which covers the obligations of any workers or subcontractors on behalf of the company. Get a How to calculate a Performance Bond?

Who are the three parties to a performance bond?

The three parties to a performance bond are the Principal, who is binding themselves in their obligations; Obligee, who receives and expects those promises fulfilled; and Surety as a third party guarantor.

What is the difference between a surety bond and a performance bond?

A surety bond is a type of contract that protects the contractor from financial loss, while performance bonds are only applicable to agreements involving specific work.

What is the difference between a performance and payment bond?

Among other things, one secures promises to perform in accordance with terms of contract while another protects laborers against nonpayment. Need a How to be released from a Performance Bond?

What is the difference between a performance bond and letter of credit?

A Letter of Credit is a promise by a bank to advance money, up to the amount stated in the letter. A Performance Bond guarantees that if one party defaults on their obligations then another entity will take over those responsibilities.

What is a good Performance Bond rate?

What is the Average Performance Bond Rate?

The typical rates and costs can range from 1% – 5%. This is only a general estimate, while an expert contractor may get lower bond rates than someone with poor credit issues or financial deficiencies.

What is a good Performance Bond rate?

A performance bond, also known as a guarantee or surety bond, is an insurance policy that guarantees the completion of work on time and within budget.

Get in touch today to find out more about what we can do for you!

How much is a typical performance bond?

The cost of the premium is usually less than 1-3% of your contract price, but will be higher if credit-worthiness isn’t sound. Labor and material payment bonds are companions to the performance bond as well.

What is a 50% performance bond?

A Performance Bond is a way to protect yourself – the Owner of the project. If you are an owner and your contractor doesn't finish their work, then they will be liable for up to 50% or 100% (depending on what type of bond it is) of whatever was agreed upon in their contract with you.

What percentage is a performance bond?

A performance bond is a financial guarantee to ensure the provider of services will complete those services for you. It costs about 1-3% on average, but can go up if it's larger than $1 million in value. Read our What does it take to get a Performance Bond?

What is a 10% performance bond?

A 10% performance bond is typically used to protect a client from the difficulties of finding another contractor and completing work. The compensation given can enable them through these difficult times, for instance if the original builder did not perform their job satisfactorily.

How long does a performance bond last?

Performance bonds are a way for an employer to ensure that they will be paid if the contractor doesn't work. They usually last one year and require renewal, but it depends on your bond type and term length. Some people can get lower rates at their next renewal date! View our What does a Payment and Performance Bond cover?

How do I get a performance bond?

In order to obtain one of these, you'll need to contact your local bonding company and submit an application for the amount required. You might also be asked about creditworthiness so it's important that any delinquent bills are taken care of before getting the surety bond.

What does a performance bond cover?

The performance bond will protect the owner against possible losses in a case that the contractor fails to perform or is unable. It defines compensation as the amount covered under this agreement.

Who obtains a performance bond?

A performance bond ensures that if the other party of a contract does not meet their obligations, you will be compensated. A bank or an insurance company usually issues these bonds as guarantees against failure to fulfill contractual duties.

Should I get a performance bond?

Performance Bonds offer plenty of advantages to all the interested parties. A contractor becomes a marketable company, is safe and secure in their deal with your bond issuer, and you get a new client on board for construction season!

When can you release a performance bond?

Typically, the performance bond will stay in effect until either after practical completion of a project or once all defects have been addressed. Here's a What does a Bid and Performance Bond cover?

What does it mean to release a performance bond?

To release a performance bond, you need to be prepared and have the right documentation. What's most important is that if your trade license expires or the contract has been fulfilled then there will be no more use for the document in question!

What happens when a performance bond is called?

When a performance bond is called, the obligee can terminate their contract with the principal and call on the surety to meet its obligations under that same bonding.

Are performance bonds refundable?

Performance bonds are refundable, but you must have not submitted your bond to the Obligee/State. If this is the case and if you send back the original bond, sometimes a full or partial refund can be provided – only if there's no one else claiming it!

Can a performance bond be extended?

Most performance bonds will have a contract period, meaning that the bond has an end date. However before this time expires, you can renew or extend your coverage for added peace of mind! Need a What happens if you Sign a Contract before you can get a Performance Bond?

What is Cost of a Construction Performance Bond?

What is the Cost of Performance Bonds in Construction?

Construction performance bonds are typically for 3% of the contract value. Rates can be as low as 1-2 per cent or higher, depending on your level of risk and the duration you choose to invest in a company.

License and permit bond costs vary widely and are rated completely differently. They go from $100 to up to 10%.

Cost of Construction Performance Bond

This type of contract ensures that the contractor will complete all work on time, within budget, and in accordance with specifications. If not, then the surety company pays for any damages or losses.

The cost to get this coverage varies depending on factors like your location and how much you're willing to pay up front. You can find out more about what it costs by filling out our quick form here!

How much do performance bonds cost?

Generally, bond costs are based on your credit score. A 1% rate will be $200 for every $20,000 in bonds while 15% is 3x as much at only $3,000 per year with up to 20 years worth of coverage available!

What is the average cost of a performance and payment bond?

The cost of a performance bond can be as low as 1% or less, depending on the credit-worthiness of your contractor. Labor and material payment bonds are companions to the performance bond.

Who pays for a construction performance bond?

The performance bond is paid for by the party providing their services under an agreement. Construction is one of the most common ones to use because they're so important in those industries.

Should I get a performance bond?

Performance bonds offer plenty of advantages to all involved parties. Contractors can turn a profit, contractors are protected from losses and the bond issuer gains an additional client. It may be time for performance bonding this season!

What is required to get a performance bond?

In order to get a performance bond, contractors need to pay interest on the required amount. Oftentimes, you will first have to go through something called bid bonding before bidding on projects with this type of security deposit. Need a Performance Bond example when the Owner is the Builder

What is the difference between a performance bond and a bank guarantee?

A major difference is that under a bond, you have no say in who will be paid if things go wrong on your project; however with guarantees, it's up to you to decide which party should receive payment when there is non-performance from an underlying contract.

How long does a performance bond last?

Performance bonds are usually renewed one year after purchasing, but depending on the type and term of a bond it may renew for 2 or 3 years. Some do not renew at all.

How does a performance bond work?

To make sure contractors complete designated projects, banks and insurance companies issue performance bonds.

What happens when a performance bond is called?

If the obligee declares the principal in default and terminates a contract, it can call on the surety to meet its obligations under this bond. Find a What does it take to get a Performance Bond?

When can a performance bond be released?

As a rule, the release of your performance bonds will be when it has been determined that you have either completed all of the project's tasks or corrected any defects.

What does it mean to release a performance bond?

Bonds are often used as collateral for contracts or licenses, and should be released when the original purpose is no longer valid. If you're not sure whether your situation warrants releasing the bond, give us a call! Read a What does it mean 100 Percent Performance Bond?

What does a performance bond cover?

A performance bond covers losses incurred to the owner by a contractor failing or not being able to deliver. The purpose of such compensation is for owners who may have lost money due to no fault on their part, but also make sure that contractors are incentivized and motivated enough in order keep them from letting things slip through as well.

Do you get your money back on a performance bond?

Are you frustrated that your performance bond is not paying out the way it should? Surety bonds can be an excellent investment, but they come with a few caveats. When opting for surety bonding services, make sure to do thorough research so as not to get into any sticky situations!

How does a performance guarantee work?

A performance guarantee is a contractor's promise to complete the project undertaken. If they fail, then you are guaranteed compensation for losses up to what was put down as your bond amount!

Difference between a surety bond and performance bonds?

Performance bonds are one type of instrument, used to help define business contracts when an owner wants to hire a contractor. Surety Bonds are another such tool for defining agreements in general; this term encompasses all types of Performance Bonds as well.

What happens when a performance bond expires?

A performance bond is typically in place for the duration of one contract. When that time period ends, it will automatically expire without any need to renew or extend it. See a What is a Performance Bond on a Construction Project?